Risk, FEMA Flood Zones, and Insurance Premiums

This article is written to aid property owners regarding their flood risk. Floodplain Managers, flood insurance professionals, surveyors, etc. may note that this information is high-level and not every variable is covered. Even so, it is hoped this information helps those not directly involved in the industry understand the basic terms and how they relate to flood risk and flood insurance rates.

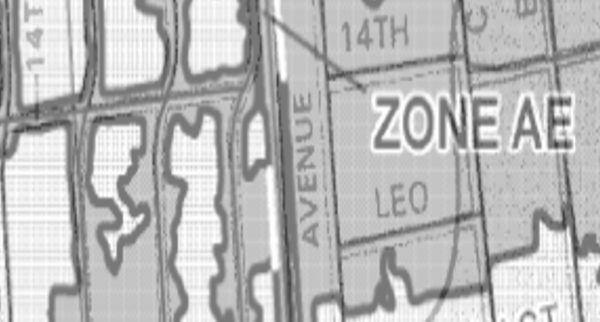

The Federal Emergency Management Agency (FEMA) creates Flood Insurance Rate Maps (FIRMs), which are the official maps of a community on which FEMA identifies flood hazard areas (zones). FEMA uses engineering standards to draw the 100-year (1% chance in any given year), and sometimes the 500-year (.2% chance in any given year), floodplain boundaries. Each of those boundaries is labeled with a Flood Zone letter, and sometimes an additional letter or number. If your property is in a zone beginning with an “A” or a “V”, your federally regulated lender will require you to purchase a separate flood insurance policy.

So, what do those zone letters mean and how are they related to your flood risk?

The First Letter

If your flood zone is “V” or starts with a “V”, it is a 100-year floodplain and the anticipated flooding is caused by coastal water. That’s the water that surges on the coast during a storm and spreads inland.

If your flood zone is “A” or starts with an “A”, it is a 100-year floodplain and the flooding is caused by non-coastal waters, which includes rivers, lakes, ponds, streams, and other fresh-water sources. An “A” zone could also be caused by ponding, or the collection of rainfall.

If your flood zone is “X”, “B”, or “C”, that means it is not a 100-year floodplain and the government doesn’t require you to buy flood insurance. Further, if your flood zone is a B or an X with shading on the map (aka X500), that means it is a 500-year floodplain; not a Mandatory Purchase area, but one of higher risk than the “C” or “X” (unshaded) zones.

The Second Letter

Not all zones have a second letter, but some do and each of them represent something different.

If the second letter of your zone is “E” (e.g. Zone AE, Zone VE), that means the flood map is printed with flood elevation information.

If the second letter of your zone is “O”, that means shallow flooding with sheet flow is expected with a 1% chance in any given year. Base flood depths (1, 2, or 3 feet) are provided instead of Base Flood Elevation.

If the second letter of your zone is “H”, that means ponding or shallow flooding.

The Numbers

Many older maps show the base flood elevation relative to a datum in the zone itself (e.g. V7 or A14). AE and VE are used on newer FIRMs instead of A# and V#.

What That Means for Risk and Insurance

Homeowners policies only cover water damage caused by things like burst pipes. To be protected from flooding caused by storms, you need a special flood insurance policy.

Naturally, the higher the risk, the more expensive flood insurance premiums will be. The zone is one of several factors in rating government-backed, National Flood Insurance Program (NFIP), insurance and almost all private carrier policies. Therefore, V zones will be the most expensive, followed by A zones, with C or X zones having the lowest premiums.

As was previously alluded to, elevation plays a key role in determining the zone; it also is a factor for determining the cost of an insurance policy. The Base Flood Elevation can be thought of as the elevation at the edges of the 100-year line. So, a structure with an elevation equal to the Base Flood Elevation at that location would be at the 1% chance. The further the structure’s elevation is below the Base Flood Elevation, the greater the risk, and consequently the higher the flood insurance premium. If the elevation of a structure in a 100-year zone is unknown, a worst-case depth will be assumed. This is rectified by elevation certificates. A licensed engineer or land surveyor can determine the elevations for your structure and the premium will be refined based on the actual elevation at your lowest finished floor. While an elevation certificate may cost a few hundred dollars, it can save you thousands in insurance premiums over time.

Government or Private Insurance

The roots of government-backed flood insurance date back to 1968, with Congress addressing the lack of availability of flood insurance in flood-prone areas. At that time, the private market was unwilling to absorb the concentrated risk associated with major flood events. This spurred Congress to create the National Flood Insurance Program (NFIP).

In 1973, the purchase of flood insurance in Special Flood Hazard Areas (the A* and V* zones) became mandatory for mortgages backed by federally regulated lenders. NFIP policies are sold by insurance companies under the Write Your Own (WYO) program. The WYO insurance company is responsible for all aspects of servicing the NFIP policies, while FEMA underwrites the risk.

The advancement of risk modeling and other factors has prompted many private insurance carriers to re-enter the flood insurance market. A 2012 Congressional reform Act included a directive for lenders to accept private policies that are as broad as an NFIP policy, and that is now a regulatory requirement. Private policies can be reviewed and their compliance verified at www.privatefloodclearinghouse.com. Additionally, excess policies (insurance above the NFIP maximum coverage) are totally from the private carriers.

Generally speaking, private policies are found to have lower premiums in the high-risk (A* and V* zones) areas. NFIP policies are price competitive or better for non-SFHA. However, that’s a broad view; you need to consult an insurance professional and do your research.

At MassiveCert, we provide a service that can help. Our FloodRisk Advanced product provides a detailed risk analysis for your particular property, explains the risk factors in plain English, and backs it up with hard data.

Participating vs Non-Participating Communities

To be able to purchase an NFIP policy, your community must participate in the program. Most communities do, and your insurance agent can confirm that for you. Participation in the NFIP is voluntary. To join, the community must adopt a resolution of intent to participate, cooperate with FEMA, and have a floodplain management plan that meets NFIP criteria.

Part of the NFIP is the Community Rating System which provides participating communities insurance premium discounts for their constituents by enhancing floodplain management.

Tying it all together

FEMA flood maps identify zones which reflect the flood risk in that area. If your collateral for a mortgage is in a SFHA zone, your lender will require you to get flood insurance. Homeowner’s policies don’t cover flooding from external sources (storms, dam or levee failures, etc.). There are government backed (NFIP) and private flood insurance options available. Even if you are not in a mandatory purchase area, you are still at risk of flooding; flood waters don’t know where the lines are drawn on the map and storms do appear to be getting more severe and frequent. The relationship between the BFE and a structure's elevation further determines the flood insurance premium. Elevation Certificates can reduce the cost of NFIP premiums. It pays to research and shop around for the best flood insurance option for your situation. MassiveCert has products and services that can aid property owners, insurance agents, lenders, and other stakeholders in making prudent flood risk decisions.